Overall, the Canadian real estate industry continues to be performing well in the back half of 2017, with the apartment sector holding strong. According to the 2018 Emerging Trends in Real Estate report, published by PwC Canada and the Urban Land Institute, one trend we’re seeing a lot of this year is the development of new mixed-use properties by major pension funds and large institutional investors (including REITs). These properties tend to be a combination of commercial, retail, service, and residential, creating brand new, mixed-use communities in Canada’s major urban centres.

Rental properties in Montreal, Quebec City and Halifax remain in high demand. Quebecers have long looked at rental favourably, and the market is particularly strong for those properties that are centrally located where residents can embrace a “live-work-play” lifestyle. Interest in Montreal rental property is so strong, in fact, that mid-sized players, as well as industrial and commercial developers, are beginning to take notice and move into the apartment market. In Halifax, a lot of the rental stock coming online is condo-quality.

In British Columbia, strong demand accompanied by even stronger pricing and highly compressed cap rates have convinced many long-term holders of multifamily properties in Metro Vancouver to cash out in the first half of 2017 amid a rising interest rate and bond yield environment that could move the market into a post-peak-pricing phase. According to Avison Young’s Fall 2017 British Columbia Multifamily Investment Report, sales of multifamily assets in the first half of 2017 roared back with 47 transactions valued at $658 million. The second half of 2016 had recorded just 30 transactions valued at $262 million while the first half of 2016 registered 43 transactions valued at $472 million. Multifamily investment activity in 2017 is on pace to easily surpass the 73 transactions valued at $734 million set in 2016. The record was set in 2015 when 80 properties valued at $1.41 billion traded hands.

Meanwhile in the GTA, product continues to be at a shortage. In its report, Avison Young cited that multi-residential properties were the least-traded asset class in Q3, despite investment dollar volume rising 43% quarter-over-quarter to $475 million. Nevertheless, year-to-date multi-residential sales are up 21% year-over-year to $1.1 billion.

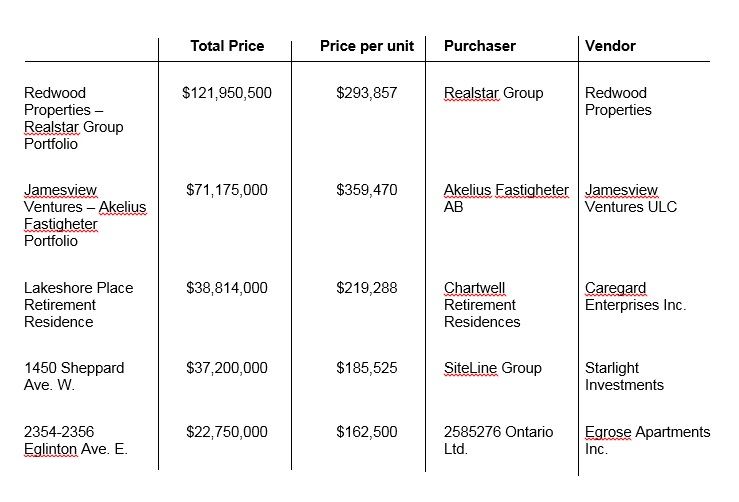

Two portfolio trades helped drive the sector’s quarterly performance: Redwood Properties sold two high-rise buildings (415 units) in Brampton to Realstar Group for $122 million, while Akelius purchased three properties (191 units) in the City of Toronto from Jamesview Ventures for $71 million.

Notable Q3 transactions:

Thank you Canadian Apartment for the Q3 2017 apartment market highlights!