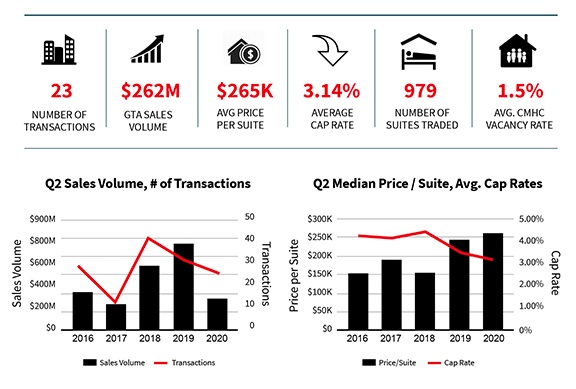

After a record-breaking 2019 and Q1-2020, the GTA multifamily investment market has felt the effects of COVID-19 with Q2 transactions plummeting to just 23 in total. This, according to JLL Real Estate Services, is the second lowest sales volume in the past five years, dropping 66 per cent year-over-year to $262,428,000.

Highlighting the quarter was the Flagship Property-Timbercreek portfolio with nine apartments for a combined price of $143,360,000. This was the largest of the Q2 transactions accounting for 55 per cent of the total Q2 sales volume. The median price per suite increased 10 per cent to $265,000 and cap rates continued to compress to 3.14 per cent, down 25 basis points.

Looking back

In 2019, the GTA multi-residential investment market witnessed over $3.3 Billion in transaction volume, shattering the previous benchmark set in 2018 by almost $1 Billion. The year was capped off by the largest single multi-residential transaction in Canadian history, as Starlight Investments acquired 6,271 suites for $1.7 Billion in the Continuum REIT privatization, of which 4,708 suites were in the GTA, representing $1.44 Billion. Not only did volume transaction increase, capitalization rates continued to compress, and the average price-per suite reached a new historic high of $288,739.