Amid the dual crises of a nationwide housing shortage and the COVID-19 pandemic, policymakers and advocates looking for solutions to housing instability have been turning to policies like rent regulation, eviction moratoriums and other emergency means to keep vulnerable tenants in their homes. But are these policies working—and how are they impacting supply and affordability in the long-run?

A new report released by the Urban Land Institute delves into the benefits and drawbacks of prevailing housing strategies while looking at ways to encourage new development. Entitled “Stable Residents, Stable Properties: Perspectives on Rent Control, Eviction Moratoriums, and Other Contemporary Approaches,” the report asserts that the stability of renters cannot be separated from the stability of the rental properties in which they live. Offering strategies to offset housing disparity, the detailed analysis includes the perspectives of more than 300 renters, tenant advocates, public officials, housing affordability researchers, property owners and developers, and identifies numerous factors that threaten the well-being of tenants and housing providers alike.

As the saying goes, desperate times call for desperate measures, and therefore the general consensus among respondents was that interventions were necessary to prevent a surge in homelessness.

“The onset of the COVID-19 crisis and associated economic disruption has created considerable challenges beyond the baseline level of vulnerability,” the report contends. “The combination of eviction moratoriums, rental assistance, stimulus payments, and enhanced unemployment benefits has spared many (though certainly not all) households the most disastrous financial consequences.”

In 2020 and 2021, moratoriums and other supports in the U.S. helped contribute to an eviction rate that was half its 2019 size. Better still, the “eviction tsunami” feared when the federal moratorium expired in August 2021 didn’t fully materialize, although filings by landlords increased.

Still, the long-term trajectory remains unclear. As the Omicron variant rips through North America creating further economic upheaval, many are predicting a sustained upward and elevated eviction trend is on the horizon—a scenario that would benefit no one. As one interviewee put it, “Eviction causes loss…not just a loss of home(s). People lose their communities. Kids lose their schools.”

Challenges facing rental housing practitioners

Challenges facing rental housing practitioners

Meanwhile, for those in the business of rental housing, the most frequently cited challenge thoughout 2020-2021 was the inability to evict tenants during eviction moratoriums, even after practitioners felt they’d demonstrated a commitment to working with tenants affected by the pandemic. Many said they felt moratoriums led to fewer tenants seeking emergency resources or working to access rent support. Some cited concerns that regulations were affecting their ability to remove tenants who were destructive to property or threatening other tenants.

Furthermore, an emerging pattern suggests that many housing providers have faced the “twin financial difficulties” of decreased rent collections and increased payroll and operating expenses related to enhanced health and safety measures. A 2020 survey of owners and operators by the National Apartment Association found that respondents spent about half their rental revenues on mortgage payments and property taxes, which are often inflexible and must be paid to avoid default or tax foreclosure. An additional 38 per cent of earnings was spent on “keeping properties up and running.”

In terms of rent collection, a survey of landlords conducted by the Housing Crisis Research Collaborative found that the share of landlords who collected 90 per cent (or more) of charged yearly rent in 2020 fell from 89 per cent to 62 per cent, while 9 per cent of respondents collected less than half.

As in Canada, smaller property owners were more likely to face considerable nonpayment challenges, which can develop beyond lost profits and affect the owner/manager’s ability to address both acute and long-term maintenance issues. When deferred for too long, issues with the building can compound into larger, more costly problems leading to health, safety, and “quality of life” issues for tenants.

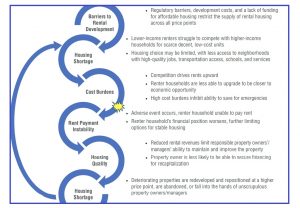

“Deteriorating housing quality eventually exacerbates the shortage and heightens competition for the remaining modestly priced, decent rental homes, creating further instability,” the report concludes. And thus the cycle of instability continues…

So what are the recommended strategies?

There are ways to break the cycle of housing instability and move toward a more stable, balanced supply. For instance, as the COVID-19 crisis shifts from an acute emergency to an endemic reality, the goal should be to move beyond emergency measures like eviction moratoriums and create a more sustainable policy framework. Strategies explored in the report include:

- Increasing funding for emergency rent assistance and long-term supports, like permanent supportive housing and financial coaching programs;

- Creating more rental housing for low- and moderate-income households, through approaches like zoning reforms that allow for more multifamily housing;

- Implementing “anti-gouging” policies that prevent landlords from raising rents above a certain percentage;

- Improving access to tenants’ rights information and empowering renters to know their options for defending themselves.

This is a merely a preliminary overview of some of the discussion points raised in the report. For the detailed analysis, please click here.