As the second quarter of 2022 approaches, all signs indicate the rental market is bouncing back thanks to improvements in economic conditions, increased migration, and high vaccination uptake reducing the need for widespread pandemic containment measures. But what’s welcome news for apartment owners is worrisome for lower-income renters.

According to CMHC’s 2022 Rental Market Report, affordable housing supply continues to fall short of demand in most Canadian cities. The majority of markets surveyed in 2021 cited a relative lack of affordable units for households in the lowest income quintiles, while some reported significant declines.

“Our data indicates that rent growth has exceeded wage growth in most centres between October 2020 and October 2021,” said Gustavo Durango, Senior Economist at CMHC. “In real terms, the decline in wages over the course of the year exceeded the decline in rents, which further deteriorated affordability conditions.”

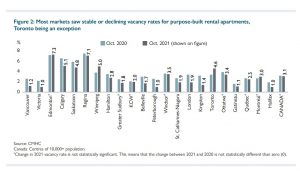

While the national vacancy rate for purpose-built rental apartments hovered at 3.1 per cent—down slightly from 3.2 per cent in 2020—vacancies declined more sharply in 21 of the 39 census metropolitan areas surveyed. Vancouver, and most cities in Alberta, Saskatchewan, and the Atlantic region, all experienced low vacancies akin to 2019 levels.

While the national vacancy rate for purpose-built rental apartments hovered at 3.1 per cent—down slightly from 3.2 per cent in 2020—vacancies declined more sharply in 21 of the 39 census metropolitan areas surveyed. Vancouver, and most cities in Alberta, Saskatchewan, and the Atlantic region, all experienced low vacancies akin to 2019 levels.

Toronto, Winnipeg, and Abbotsford-Mission were the only markets in Canada that saw a rise in vacancy rates, while 13 city centres held steady—including, notably, Montréal which accounts for roughly 30 per cent of Canada’s rental market universe.

“The vacancy rate in the Montréal remained stable at 3 per cent in 2021,” commented Francis Cortellino, Economist. “The gradual resumption of international migration and the return to in-person classes decreased the vacancy rate in the downtown area, but it remained at a higher level than before the pandemic.”

In Vancouver, however, the apartment vacancy rate dropped from 2.6 per cent in 2020 to 1.2 per cent in 2021. The return of students and increased migration led to tightening conditions that have since intensified the existing imbalances in the rental market. Throughout the pandemic, lower-income households faced significant challenges finding affordable units; even with B.C.’s rent freeze temporarily easing pressure for existing tenants, rents increased in 2021 by roughly 2.1 per cent at unit turnover.

“With the return of economic growth, rental demand increased faster than supply in 2021,” commented Eric Bond, Senior Specialist, CMHC. “The Vancouver rental market again faces many of the same imbalances it did in 2019.”

The good news for Vancouverites is that more rental housing seems to be coming. CMHC’s data indicates rental starts during the first three quarters of 2021 increased 31 per cent year-over-year, signalling that new construction will soon be bringing much-needed supply to the west coast market. But will there be enough affordable units to address the growing need?

Unlikely, given new rental buildings tend to garner higher rents. That said, CMHC research shows some relief is typically seen at the regional level when demand is eased for existing housing.

GTA market: slower to recover

In Toronto, it continues to be a slightly different story. Throughout 2021, the lingering effects of the pandemic impacted the purpose-built rental sector negatively, leading to a second consecutive annual increase in the average vacancy rate. Ontario faced more stringent COVID-virus containment measures compared to other provinces, and restrictions were often implemented for longer periods of time given case counts were higher in the dense Toronto neighbourhoods. As 2021 unfolded, those measures continued to disproportionately impact service-sector industries that were more reliant on in-person interactions, delaying the economic recovery for segments of the population that were more likely to rent. Although the vacancy rate for purpose-built rental apartments in Toronto rose to 4.4 per cent, the number of affordable units geared to lower-income renters declined.

“The stock of row and apartment units affordable at 30 per cent of monthly income, to low- and middle-income renter households decreased from the previous year, down 0.6 per cent and 0.4 per cent for the second- and third-income quintiles, respectively,” the report states. “Our data indicates that removals in 2021 due to demolition, condominium conversion, or for the owners’ own use, were concentrated mainly in the City of Toronto.”

Meanwhile, the average monthly rent for condominium apartments in Toronto was 45 per cent higher than the average rent for purpose-built rental units, and vacancies were significantly lower at 1.6 per cent. CMHC accredits this discrepancy to the fact that higher income earners were less impacted by the pandemic, and therefore more able to afford the higher rents.

Other key markets:

In Ottawa, rental demand in 2021 increased sufficiently to offset the addition of a considerable number of units that were added to the rental stock. The vacancy rate remained stable at 3.4 per cent, the highest its been in the last 25 years. Yet, according to the data, options were still limited for lower-income households.

In Edmonton, the average vacancy rate was 7.3 per cent, statistically unchanged from October 2020. Rental demand kept pace with supply increases, and was backed by improved labour market conditions, the return of students and improvement in international migration. Though less of a challenge than in other Canadian centres, the supply of affordable purpose-built rental options remained on the low side compared to the need.

In Halifax, the vacancy rate declined to just 1 per cent in 2021, with rental supply unable to keep up with the higher demand. Canadians fleeing COVID-19 restrictions, crowded the city resulting in record interprovincial migration trends. Lower vacancy rates and higher rents likely challenged lower-income households, young adults, fixed-income seniors and new immigrants searching for affordable rental apartments.

For the complete report, click here: www.cmhc-schl.gc.ca