A new study by Online Mortgage Advisor compares the average monthly salary in hundreds of cities worldwide with the average monthly rental fee for an apartment located within each city market to calculate the change in rental affordability since 2018.

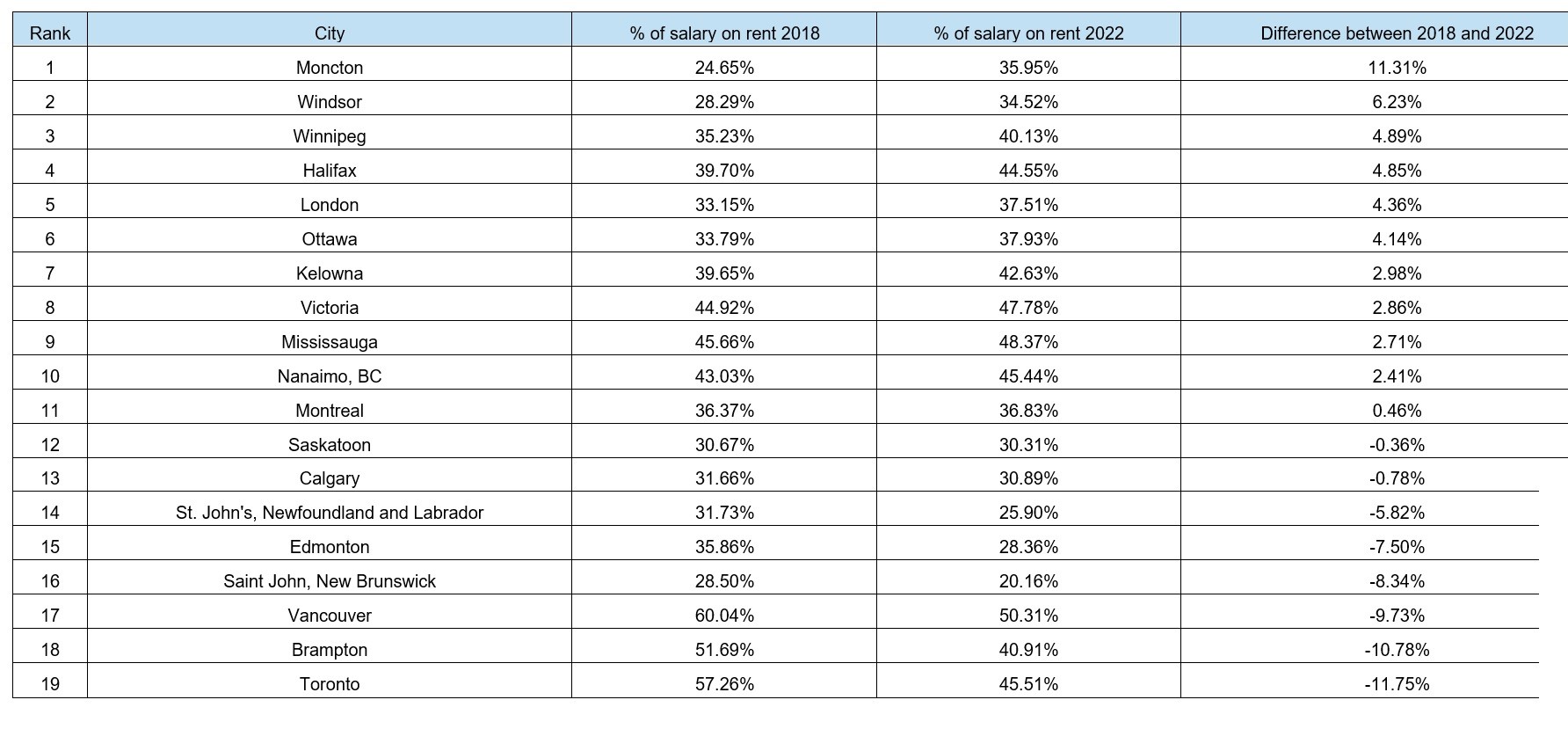

Surprisingly, Toronto had the biggest positive change in rental affordability in Canada — and on the North American continent. According to the study’s findings, renters in Toronto in 2018 were paying 57.26 per cent of their salaries on rent, whereas in 2022, it dropped to 45.51 per cent. Meanwhile, Moncton, NB, is experiencing the largest shift in the opposite direction, with renters now paying 36 per cent of their incomes on rent, representing an increase of 11.3 per cent since 2018. Windsor, ON, Winnipeg, MB, and Halifax, NS, also recorded substantial increases.

Canadian cities by-the numbers:

But Canadians aren’t the only ones facing higher rent prices in relation to their incomes; globally speaking, 45.5 per cent of the cities included in Online Mortgage Advisor’s study became less affordable for renters between 2018 and 2022, with Sharjah, United Arab Emirates, taking the prize. Since 2018, average rent vs. income in Sharjah soared from 44 per cent in 2018 to 438 per cent in 2022, making it the most expensive rental market in the world.

In terms of purchasing a property, Edmonton ranked second globally as an affordable option for average income earners in 2022 versus 2018, while Calgary placed sixth on the list. Johannesburg, South Africa, saw the biggest increase in property affordability worldwide.