The GTA housing market is on track for a record year in resales, but there may be challenges on the horizon.

Industry analysis suggests they have nothing to do with a real estate bubble, with price growth firmly rooted in the market fundamentals of supply and demand. They have to do with housing affordability and government fees and policies, existing and contemplated, that threaten to further erode it.

These were some of the key messages to come out of the Building Industry and Land Development Association (BILD) and Toronto Real Estate Board’s (TREB) first ever joint media briefing on the state of the GTA housing market last week.

Steve Deveaux, board chairman for BILD, said in his introductory remarks that one of the event’s goals was to give residents an understanding of the dynamics driving the market.

“Affordability of housing is a major issue in the Greater Toronto Area — especially when it comes to low-rise homes,” he said.

Deveaux explained that it would take an annual income of slightly less than $175,000 to comfortably afford an average-priced (roughly $962,000) single-family home in the GTA with a 20-per-cent down payment. In 2013, the average total family income in the Toronto area was slightly more than $107,000, according to Statistics Canada.

“And while we as an industry will continue to innovate where we can, innovation alone cannot address the challenge of affordability,” he said.

A structural shift in new homes supply

The number of home resales tracked through TREB’s MLS system is expected to crack six figures for the first time this year, besting its 2007 record in the low 90,000s. Add new home sales reported by RealNet to the equation and total transactions for the first 10 months of the year have already topped 124,000.

Jason Mercer, director of market analysis and service channels for TREB, said these figures underscore strong demand for ownership housing. But, without further breakdown, they fail to capture a shift in the housing options coming down the development pipeline.

“It’s hard for people to miss a new 30-storey building that’s being added to their community — especially when it takes three to five years to create,” as George Carras, president of RealNet, put it. “What’s easy to miss is the diminishing number of ground-oriented housing options that are now available in the marketplace.”

As of Oct. 31, 2015, RealNet data showed that new homes inventory in the GTA sat at 26,000, of which more than 21,000 were high-rise options and fewer than 5,000 were low-rise options. That compares with the new homes inventory of nearly 30,000 in the GTA a decade earlier, which tilted in the opposite direction, with 13,000 high-rise options and almost 17,000 low-rise options. And since those new homes eventually supply the resale homes market, explained Carras, this structural shift has had a trickle-down effect.

Ten years ago, MLS contained three months’ worth of low-rise inventory, whereas today, MLS contains half as much low-rise inventory.

“If you’re seeing more competition between buyers — a lot of demand versus a flat line to declining supply in a lot of neighbourhoods — the result is consistent upward pressure on price,” said Mercer.

Conversely, added Carras, growing levels of high-rise inventory have to some extent moderated price increases in that segment of the market.

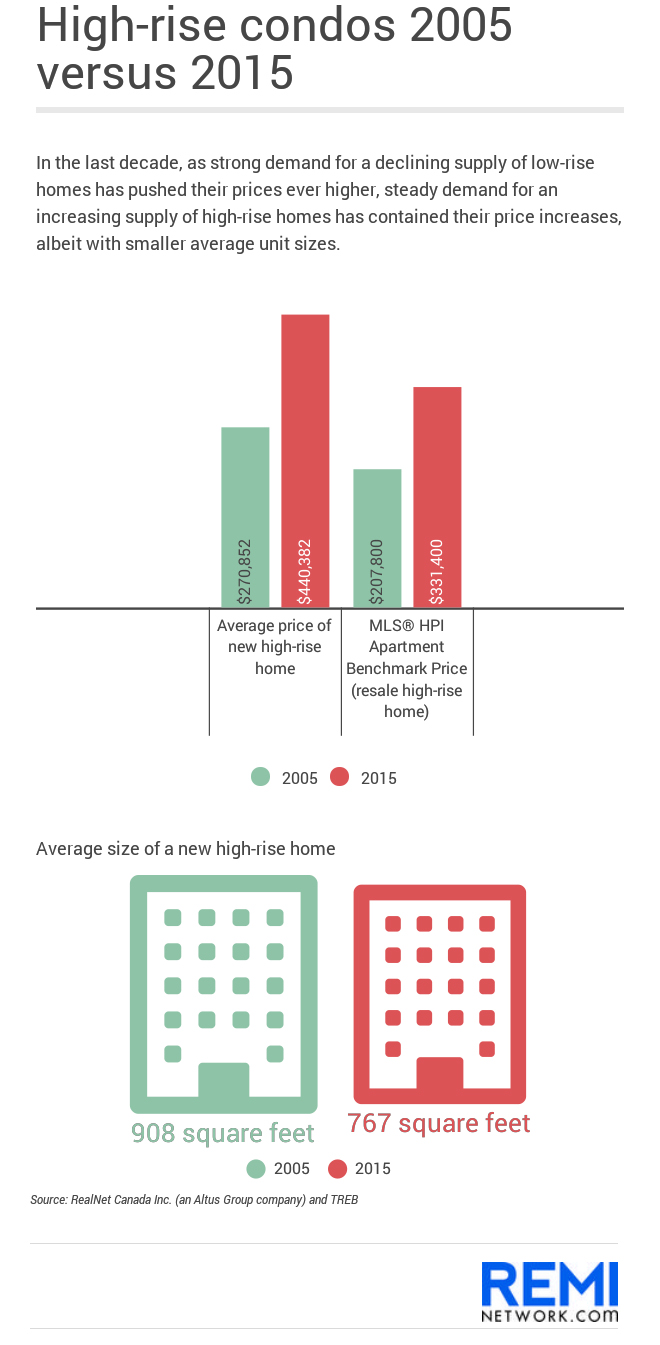

As the MLS® HPI benchmark price of a resale single-family home in the GTA rose from $363,100 to $669,400 in the last decade, the the MLS® HPI benchmark price of a resale apartment home in the GTA rose from $207,800 to $331,400. During the same timeframe, RealNet data shows that the average price of a new low-rise home grew from $387,369 to $802,376 and the average price of a new high-rise home grew from $270,852 to $440,382.

The upshot of the shift in the supply of new homes has been a widening price gap between low-rise and high-rise options, both resale and new.

“If you look at that price gap in the new homes market, back in October 2005, that gap was $98,000; that gap today is just under $362,000,” said Carras.

At one point, noted Mercer, there were fears that starting in 2013, record numbers of high-rise completions would put downward pressure on prices in that segment. However, that scenario never came to pass.

“There was that concern that we were going to see this glut of inventory coming into the marketplace, a ton of supply out there, a ton of choice for buyers, and we were going to see pricing drop off,” he said. “After an initial uptick in inventory levels, that was very quickly absorbed, to the point where we’re actually a little bit below the norm that we’ve seen in terms of inventory levels for condominium apartments over the last decade or so.”

With TREB’s year-to-date benchmark apartment price outpacing inflation, another factor containing the price of new high-rise homes is shrinking units. RealNet data shows that the average unit size dropped from 908 square feet in 2005 to 767 square feet in 2015.

A role for government in addressing affordability

“As an industry, we continue to innovate and work to provide a range of housing choices,” said Bryan Tuckey, president and CEO of BILD. “However, it is becoming increasingly challenging for us to design, build and sell homes that many people — especially first-time homebuyers — want and can afford.”

Tuckey highlighted findings from an August poll of 1,500 GTA residents conducted by Ipsos on BILD’s behalf. Chief among its findings was that 70 per cent of respondents expressed concern about their ability to buy their next home.

As developers have shifted toward building more high-rise homes, he said, consumer demand for low-rise homes has continued unabated. Developers are unable to meet this demand due to limited supply of serviceable land.

Other factors contributing to deteriorating housing affordability are escalating development charges, which Tuckey contended were unfairly shouldered by new home buyers, and outdated zoning that lengthens approvals processes and project timelines. As well, Tuckey noted the rise of NIMBYism, which he attributed to a lack of understanding around the province’s intensification policies.

“We’ve been able to change the way we do business, meet the demand for the 36,000 households that are formed every single year,” he said. “I think it’s important that government plays their part and helps educate the public on what this change actually means.”

Mark McLean, president of TREB, shared Tuckey’s concerns about the future affordability of housing, pointing also to speculation that the Ontario government might expand the municipal land transfer tax province wide. (The Ontario government has since stated it will not pursue this.)

“We want to work together with all levels of government to ensure that the right policy decisions are made, that allow as many people as possible to realize the dream of home ownership,” said McLean.

John DiMichele, CEO of TREB, added that the housing market represents thousands of jobs and billions in economic spin-offs. He cited an Altus study that found each home sale on MLS in Ontario generates an average of $55,000 in additional spending.

“This is what’s at stake when the several levels of government develop policies pointed directly at the housing market,” said DiMichele.

More needs to be done to promote home ownership, he continued, suggesting indexing to inflation the Home Buyers’ Plan, which allows consumers to draw on their RRSP (tax-free, on a repayable basis) for a down payment, as an example.

As the two industry groups team up to open up a dialogue between consumers, industry and government, TREB, with support from BILD, plans to release a report containing its housing market outlook at a year-in-review event this January.

Michelle Ervin is the editor of CondoBusiness.