Apartment owners across Canada are reaping the rewards of a favourable supply-demand equation fuelled by robust population and job growth, a growing preference for renting vs. owning, and a housing shortage limiting tenants’ options. According to Yardi’s latest national multifamily report, rents are expected to keep accelerating at “above-trend levels” for both new leases and renewals given the limited number of new units currently in the development pipeline, and the lack of tenant turnover.

“Canada’s economic conditions mostly support the bullish apartment outlook,” the report contends, adding that jobs are increasing at a steady rate, while population growth continues unabated. In fact, Yardi says the economy exceeded expectations by adding nearly 35,000 jobs in March, led by high wage segments including transportation/warehousing (41,000), building and support services (31,000) and finance, insurance, and real estate (19,000). Hourly wages were up 5.4 per cent as of February.

Meanwhile, the unemployment rate remained near record lows at 5 per cent as inflation fell to 4.3 per cent in March, its lowest level since August 2021. Unlike the U.S. central bank, the Bank of Canada (BOC) has decided to “hit the pause button” with short-term rates at 4.5 per cent. The BOC forecasts inflation to gradually recede to target levels over the next two years and is betting that costs will decelerate without more action on its part.

Average in-place rents

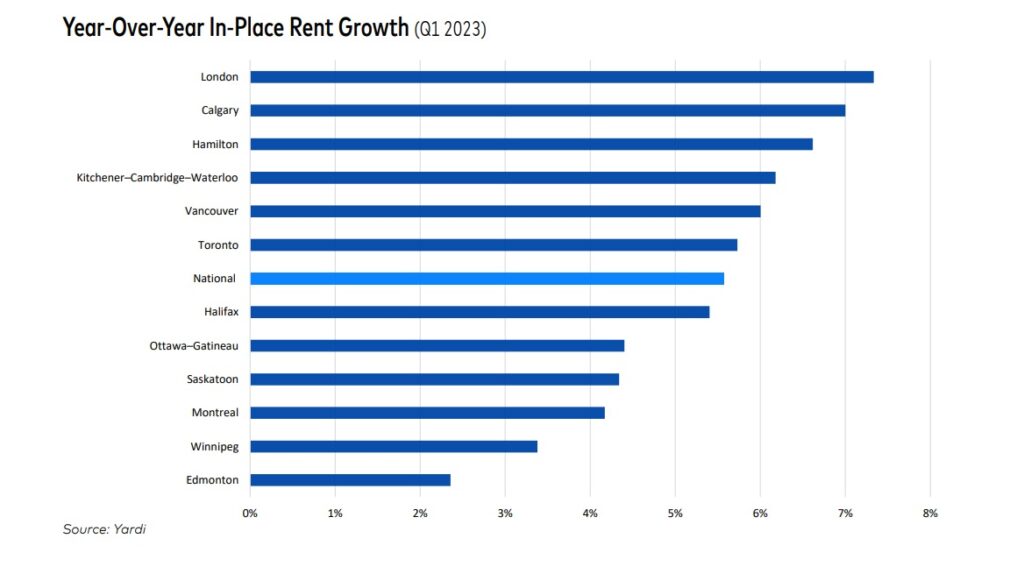

Across Canada, “in-place rents”—meaning all rents in one Census Metropolitan Area, including new leases, renewals, and existing leases—climbed again to reach record highs in Q1 2023. The average in-place rent increased $21 in the first quarter to $1,411. Year-over-year growth also accelerate, to 5.6 per cent, up 80 basis points from the fourth quarter and more than double the 2.7 per cent growth rate in Q1 2022.

Canada’s population grew by a record 1.1 million in 2022, up 2.7 per cent—the highest since 1957. Growth was concentrated in permanent and temporary foreign residents, which increased by 1 million.

Single-family home sales increased 2.3 per cent month-over-month in February, but were down 40 per cent year-over-year, according to the Canadian Real Estate Association. Population growth, higher mortgage rates, the increasing unaffordability of single-family homes and the growing number of ‘renter by-choice’ households all contribute to demand for apartments.

Yet supply is not keeping pace. Apartment buildings are not coming to market as quickly as they are needed. According to Yardi, this is due to policies such as rent control and strict zoning regulations “putting a lid on new supply,” which is an increasing problem as demand for purpose-built rentals mushrooms. According to a recent report by the Royal Bank of Canada, a 25,000- to 30,000-unit deficit currently exists in purpose-built rental stock, and that is likely to grow to around 120,000 units over the next four years as demand soars.

“Canada will need to add 332,000 units to its current rental stock between now and then to achieve a balanced market with rent stability,” the report states. “That would represent roughly a 20 per cent increase in the annual pace of construction achieved in 2022, when 70,000 rental units were completed.”

Additional facts & figures

- Between 1996 and 2012, growth in purpose-built rentals in Canada reached as much as 1 per cent of stock just once, and most years during that period it was either negative (as some units became obsolete) or barely positive (source: CMHC Rental Market Data, Statistics Canada and RBC Economics).

- The annual average growth rate of purpose-built rentals has moved closer to 2 per cent over the last decade, but the long-term deficit will take years of building to fix, especially now that the population is growing more rapidly.

- Eight of the top 12 CMAs tracked by Yardi recorded double-digit gains year-over-year, led by three in Ontario: Kitchener-Cambridge-Waterloo (19.6 per cent), Toronto (18.6 per cent) and London (16.7 per cent).

- Rent growth is lowest in the Winnipeg CMA (2.1 per cent) and the province of Manitoba (2.2 per cent).

For the full report, visit: https://info.yardi.com/multifamily-market-reports-for-canada