CAPREIT announced plans to move ahead on the acquisition of a substantial Halifax apartment portfolio comprised of eight properties containing fourteen apartment buildings and 1,503 rental suites. The buildings are well located throughout the downtown core and surrounding the Halifax metro area.

The properties have been well maintained and all are close to key amenities including the Halifax waterfront, the city’s Central Business District, schools, universities, public transport, shopping, walking trails, entertainment, and other attractions. A number of the properties contain retail components to better serve residents.

“With this purchase, we will significantly increase the size and scale of our Halifax portfolio, capturing strong economies of scale and operating synergies across our asset base in the city,” commented Mark Kenney, President and CEO. “Once completed, our Halifax portfolio will grow to over 3,100 residential suites, transforming CAPREIT into one of the city’s premier providers of quality rental accommodation.”

Occupancy for the total portfolio currently stands at 99.9 per cent. CAPREIT will pay approximately $391 million for the portfolio, satisfied by the assumption of approximately $109.1 million in mortgages with a weighted average interest rate of 1.94 per cent and a weighted average term to maturity of 1.25 years, with the balance in cash from its Acquisition and Operating credit facility.

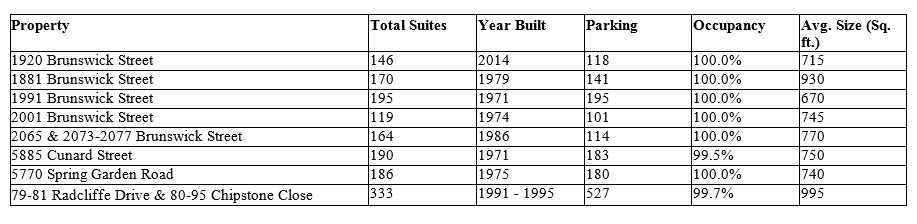

A breakdown of the Halifax apartment portfolio can be found here: