With 1,849 new rental units beginning occupancy since January, GTA rental completions have reached a 25-year high according to a new report from leading real estate consulting firm, Urbanation. Since 2005, just 13,520 purpose-built rental units have been brought to market, underscoring the significance of this growth.

“The latest data shows that market conditions remain tight for rentals in the GTA, with continued upward pressure on rents,” commented Shaun Hildebrand, President of Urbanation. “However, we are starting to see the early signs of some relief emerging as more supply enters the market from both new purpose-built rentals and condo rentals.”

As the year progresses, Hildebrand predicts that deliveries of both forms of rentals will continue to grow, which should create even more balance in the market and lead to a slower rate of rent increase than we’ve been seeing over the past three years.

“As rents have risen to new highs and population inflows into the GTA have surged, there has been a strong shift in demand to smaller units,” he said. “It’s pretty clear that rentals of all types are needed, but some projects have also experienced really good success with larger units that cater to couples, families and downsizers. Condo rentals tend to be on the smaller side, so this growing market segment represents a solid opportunity for differentiated product in the purpose-built market.”

Rental report highlights

- The demand for newly completed rental buildings was strong in Q1, with several new projects reporting they’d leased close to half of their total units by the end of the first quarter.

- Vacancy rates surveyed within purpose-built projects completed since 2005 remained extremely low at an average of 0.6 per cent.

- Cost of rent only grew by 5 per cent year-over-year on a same-building basis, slowing from a 9 per cent annual pace at the end of last year. As of Q1-2019, purpose-built rents in buildings completed since 2005 averaged $2,398, or $3.25 per square foot based on an average size of 738 square feet.

- Monthly condominium rents grew by 7.7 per cent per square foot on a same-building basis compared to a 9.2 per cent annual increase in Q4-2018. Rents in these properties averaged $2,376 ($3.28 per square foot) across the GTA—which is 7.8 per cent higher than a year ago.

- In the Central Toronto market (excluding North York, Scarborough, and Etobicoke), average condominium rents increased by 4.5 per cent annually to $2,542 ($3.71 per square foot), the slowest rate of rent growth for the central market area in two years.

“Condominium rent growth is heading towards a more moderate pace relative to the past couple of years as rental affordability challenges have become greater and more supply is entering the market from projects finishing construction,” the report stated. “Although the volume of condominiums leased through MLS grew by 13 per cent year-over-year in Q1-2019 to 6,005 units, supply grew faster than demand last quarter, pushing down the ratio of leases-to-listings to 73% — the lowest level in four years.”

As of the end of the quarter, there were 2,059 active condominium rental listings on MLS, representing a 44 per cent increase from a year ago, but still equal to less than one month of supply. Furthermore, the average time on market of 20 days in Q1-2019 was at its highest level in three years, indicating that units are taking a bit longer to rent.

Purpose-built rental applications continue to grow

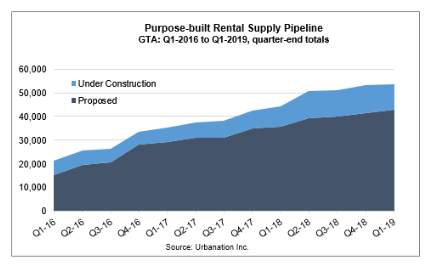

A total of 42,841 purpose-built rental apartments were proposed for development but had not yet started construction as of Q1-2019, which is 20 per cent higher than the total proposed inventory of 35,834 units as of Q1-2018 and nearly 50 per cent higher than the 28,841 units proposed as of the end of Q1-2017.

The rise in completions in the first quarter brought down the number of purpose-built rentals under construction to 10,694 units from its recent high of 11,905 units in Q4-2018, but still remained above the level from a year ago (8,510) and substantially higher than two years ago (5,894).

“The increase in rental completions in early 2019, which is coinciding with more condominium projects finishing construction, has shown that growth in new supply can have a direct impact on the rate of rent growth,” Hildebrand said. “The challenge going forward will be keeping rental construction numbers rising to a level that meets growth in demand.”