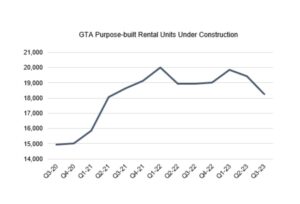

The number of purpose-built rentals under construction in the GTA fell to 18,267 units in Q3-2023, according to new data from Urbanation. This represents the lowest level of activity underway since Q2-2021.

“The recent GST announcement will provide a much-needed shot in the arm for new rental construction in the GTA, but it’s clear given recent trends that much more help is required to improve the economics of building rentals,” said Shaun Hildebrand, President of Urbanation. “The construction of new purpose-built rentals should be a primary policy objective in the battle to improve housing affordability in Canada.”

Compared to the multi-decade high of 19,994 rentals under construction in Q1-2022, when interest rates were just beginning to increase, the level of rental construction underway in the GTA has fallen by 9 per cent. The 2,938 new rental units that started construction during the first three quarters of 2023 represented a 54 per cent decline compared to the first three quarters of 2021 when rental construction was at a recent high.

Compared to the multi-decade high of 19,994 rentals under construction in Q1-2022, when interest rates were just beginning to increase, the level of rental construction underway in the GTA has fallen by 9 per cent. The 2,938 new rental units that started construction during the first three quarters of 2023 represented a 54 per cent decline compared to the first three quarters of 2021 when rental construction was at a recent high.

According to Hildebrand, the decline in rental construction was focused on the most affordable parts of the GTA within the 905 Region. These projects have been most susceptible to increased costs as rents have generally not been high enough to make new development financially feasible. At 2,955 units in Q3-2023, the number of rentals under construction in the 905 Region dropped 42 per cent from its recent high in Q1-2022 (5,083 units).

Hildebrand says the elimination of GST on new rental development is expected to improve construction activity moving forward. As of Q3-2023, there was a total of 41,034 approved purpose-built rental units in the pipeline in the GTA that had not yet started construction, including 10,113 units in the 905 Region.

Rents continued to rise in Q3

The slowdown in rental construction came at the same time as rents reached record highs in the GTA. Condominium leases transacted in Q3-2023 had average rents of $2,937 ($4.21 psf), while units that became available for lease in purpose-built rental buildings completed since 2003 averaged rents of $3,143 ($4.25 psf). Rents in both market segments were up 9% annually in Q3-2023, a somewhat slower pace compared to recent quarters reporting double-digit growth but still well above historic averages.

Vacancy rates stay below 2 per cent

The vacancy rate in purpose-built rental buildings completed in the GTA since 2003 was 1.8 per cent in Q3-2023, edging down from 1.8 per cent in Q2-2023 and remaining below 2 per cent for the seventh consecutive quarter. The market could see some short-term supply relief as 13 rental buildings totaling 2,639 units are scheduled to begin occupancy in Q4-2023, surpassing the 1,739 units completed in Q3-2023 and representing the highest quarterly total for new rental deliveries in 30 years.

For more info, visit: Latest Trends | Urbanation