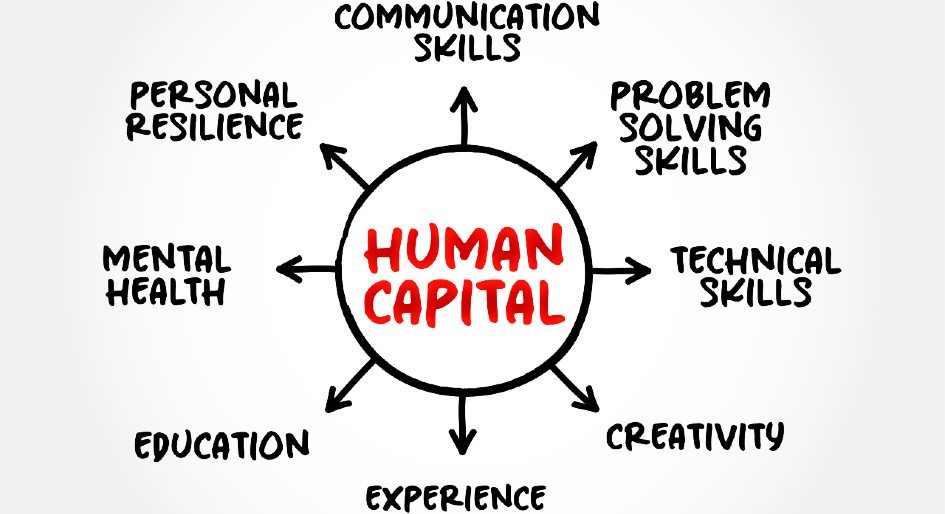

Human capital is proving challenging to procure across all functions of commercial real estate. Employers are pressed to fill new kinds of positions and to bolster tech savviness throughout their organizations, while facing labour shortages and a highly competitive market for certain skills.

Some industry insiders with career-long insight on hiring and staff development see opportunities in new recruiting methods that technology helps to enable, but also call for an “old school” approach of bringing aboard trainees and investing in on-the-job mentoring and learning. Speaking during the recent REMI Show in Toronto, Cheryl Gray, a retired senior executive and past president of the Institute of Real Estate Management (IREM) who now provides consulting services to industry clients, suggested that employers may have unrealistic or outdated perceptions of the pool of potential job candidates, particularly when the current market is unlikely to serve up a wealth of experienced applicants.

“It’s disconcerting when I hear, ‘We really can’t find someone for this position,’ and then I look at the criteria and it says they want five years’ experience,” Gray said. “If you can’t find experience, look for talent, look for attributes.”

“I know lots of people who are looking for building operators and eight months out from the opening, they still haven’t filled the position,” concurred Terry Flynn, another industry consultant who has recently retired from a managerial role with a large real estate company. “Bringing in apprentices or trainees might be more expensive for an organization initially, but they could be the future of your company.”

Joining the discussion from a facilities management perspective, Hilary Green, director of change management with Scotiabank’s workplace centre of excellence, explained how her department has tapped into the bank’s vast networks for recruitment and liaison with academic institutions. For years, thousands of students have cycled through its other business departments as interns or in co-op placements, with many later attaining permanent employment. However, corporate real estate, which is a small department in the context of the bank’s overall operations, was slower to participate in those programs.

“Now we have anywhere between 10 and 15 students a semester come in. They get to see and try out different aspects of real estate and that’s proven successful for us,” she recounted.

Skills deemed learnable, but values more entrenched

There has also been more emphasis on recruiting internally, from other bank departments, recognizing that many key skills are shared with other professional pursuits and/or can be fine-tuned for real estate project management through on-the-job learning. Extending that philosophy further, Scotiabank’s HR team has turned to “intake without resumes” in the recruitment of post-secondary students and others in their early career stages.

“There’s a tool they’re using that really just surveys for what kind of a person you are, what your values are and how that might align with the organization,” Green explained. “That’s presuming that, if you’re coming in at entry level, certain hard skills can truly be taught.”

Property management has traditionally been a career requiring flexibility, in which generalists with a range of organizational, budgeting and people skills can thrive. Meanwhile, building operations is increasingly demanding a comfort with technology and digital applications that an injection of younger workers could bring. The industry’s ongoing efforts to provide more opportunities for under-represented groups should fit well with companies’ needs for skills and their talent acquisition strategies.

Flynn urged more outreach to Indigenous youth in particular. “I don’t think our industry has done as well as it could have to help them see this could be a great career,” he reflected.

Gray applauded the concept of intake without resumes, and noted the evolving social dynamic that has made employers more aware of how they appear to prospective employees. “I think people place a lot of emphasis on what a company does and stands for,” she said.

That also flows through to the labour practices of suppliers and contractors. ESG (environmental, social, governance) mandates and regulatory requirements in countries like the United Kingdom are prompting building owners/managers to weigh this consideration in their procurement and contracting due diligence, including how it might factor into low bids.

“If you re-tender a janitorial contract, maybe you can find some cost efficiencies, but, certainly, the efficiency I wouldn’t recommend is for contractors to pay their people less,” Flynn reiterated. “They are at poverty levels now in some contracts.”

Growth pressure in ESG departments

Looking to other human resources challenges building owners/managers are encountering, Flynn underscored the need for expertise and training to keep smart and green buildings performing as designed. Similarly, a recent webinar sponsored by the Open Standards Consortium for Real Estate (OSCRE) International examined some of the staffing pressures arising from growing demands for ESG outcomes and data in the commercial real estate industry.

Ailey Roberts, principal, sustainable investing, with BentallGreenOak, described how ESG teams are navigating steep learning curves at high speed to keep pace with requirements for accurately tracking and consistently reporting on issues ranging from curbing greenhouse gas emissions to climate change adaptation to diversity, equity and inclusion (DEI). It’s a daunting data collection and management exercise with many fragmented components and still evolving methodologies.

“As it relates to data and the increased requirements around ESG, a lot of this stuff is not necessarily taught in school and certainly not within the lens of real estate. Things like greenhouse gas emissions accounting, for example; that is an incredibly complex package to unpack.” she advised. “Our ability to hire is not favourable with the way the market is right now so we need to do more with the people we have and upskill our teams.”

That’s a general trend across the commercial real estate industry. Companies that may have had a lone sustainability manager just a few years ago now need a range of expertise and a larger staff to respond to rapidly changing demands for reporting and transparency from investors and regulators. Within these nascent departments, there are likely to be few staffers with long-term experience in ESG-related roles.

“You can’t buy the skills. You can’t even buy a lot of the training because things are changing so fast. The training is often not developed yet,” reported Chris Lees, a technical director with OSCRE International. “Your best chance is to find people who are smart enough to learn, and those are the people who you want to hire anyway.”

Barbara Carss is editor-in-chief of Canadian Property Management.