Overall, housing starts activity remained high in 2022 with December trending slightly lower than previous months. In Toronto, Montreal and Vancouver, multi-unit construction led the way, with rental apartments and condominiums accounting for the majority of housing projects.

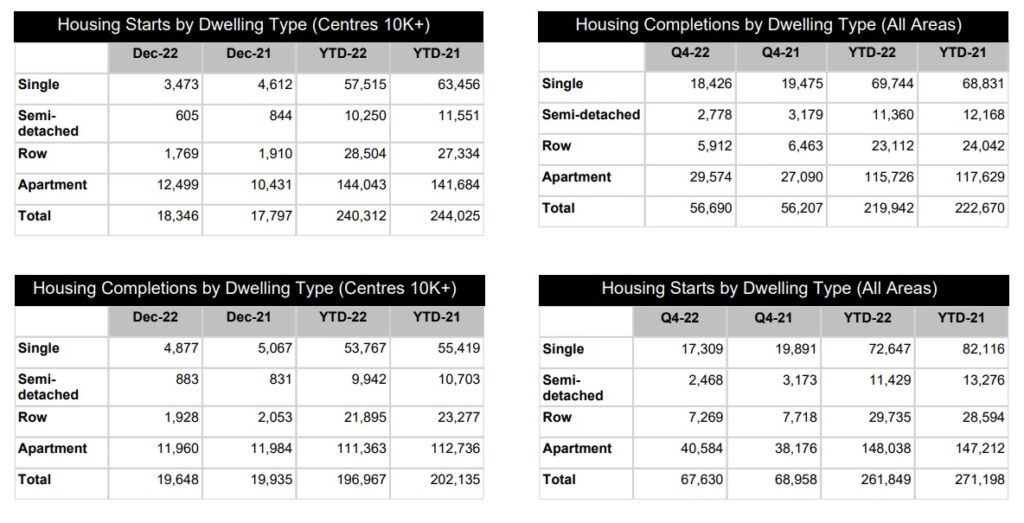

CMHC describes housing starts as “an economic indicator” reflecting the number of residential housing projects that have been started over a specific length of time. For the month of December, total housing starts in both urban and rural areas declined five per cent to 248,625 units compared to November 2022. Specifically, multi-unit urban starts decreased four per cent to 182,850 units while single-detached urban starts fell 11 per cent to 44,858 units.

“The 2022 year ended with a slight decline for both the monthly SAAR of housing starts and the trend at the national level in December;” said Bob Dugan, CMHC’s Chief Economist. “However, Toronto, Montreal, and Vancouver all posted increases in total SAAR housing starts, with Toronto posting a significant increase of 72 per cent in December. The rate of new construction continued at an elevated pace in 2022 overall, ending the year with actual total urban starts at 240,590 units (-1%) in Canada, similar to levels observed in 2021 (244,141 units). While these additional units will provide much needed supply on the market, demand for housing in the country will continue to grow. We need to find innovative ways to deliver more housing supply and keep building at a higher pace in the coming years in order to improve affordability.”

Housing starts in the Toronto Census Metropolitan Area (CMA) reached 45,109 units, which is 7.6 per cent higher than the previous year. In fact, this marked the highest level since 2012 (48,105 units) and the fourth highest number on record. CMHC said the growth in Toronto’s housing starts was “entirely attributable to the multi-unit segment” comprised of semi-detached homes, row homes, and apartments. In all, there were 38,780 multi-unit starts in 2022—the largest number on record—with the majority being apartments and condominiums.

Meanwhile in Montreal, activity was in line with pre-pandemic levels with 24,000 overall housing starts, down 25 per cent from the record year experienced in 2021. This decrease was observed across all market types (homes, rentals and condos), with rental apartments continuing to drive housing starts in the area. In 2022, rental projects in Montreal represented 61 per cent of all housing starts.

Housing starts in the Vancouver CMA totaled 25,983 units in 2022, unchanged overall from 2021 (26,103 units). Builders in the region are continuing to operate near capacity and at an elevated pace, in keeping with the trends seen there over the past five years. As construction of rental apartments surged due to strong demand, condominium starts fell, indicating developers took a more cautious approach to the segment. With higher mortgage interest rates limiting the budgets of homebuyers, CMHC believes some of the demand from ownership in Vancouver has switched to rental.

December 2022 highlights:

- The trend in total housing starts across Canada was 269,930 units in December 2022, down from 273,801 units in November 2022.

- 2022 ended with a slight decline for both the monthly seasonally adjusted annual rate (SAAR) of housing starts and the trend at the national level in December.

- Toronto, Montréal, and Vancouver all posted increases in total SAAR housing starts, with Toronto posting a significant increase of 72% in December.

- The rate of new construction continued at an elevated pace in 2022 overall, ending the year with actual total urban starts at 240,590 units in Canada. This is similar to levels observed in 2021 (244,141 units).

For more on Monthly Housing Starts and Other Construction Data visit the CMHC Housing Market Information Portal.