Investment in the Canadian commercial real estate sector is buoyed by a relatively healthy economy and a commercial property market that continues to see varying, but largely healthy fundamentals, reveals a new report by Avison Young.

Covering all investment activity in 54 markets, including Calgary, Edmonton, Montreal, Ottawa, Toronto, and Vancouver, the report shows that on a year-over-year basis, Canada recorded an increase in investment sales – up $4.3 billion, or 29 per cent compared with the first half of 2016 – in five of the six markets surveyed. Among the top-ranked transactions by dollar volume, office led the way, followed by retail and multifamily.

“The multifamily sector had a strong first half of 2017, accounting for nearly one in five dollars invested in Canadian commercial real estate,” says Bill Argeropoulos, Principal and Practice Leader, Research (Canada) for Avison Young. “This sector is probably the most restrained by scarcity of available product for sale – which has resulted in the lowest cap rates among all asset classes. Vancouver saw tremendous investment in the multifamily sector, leading the country. This is largely attributed to long-term owners taking advantage of peak pricing to sell their assets, and factoring in additional value based on properties’ redevelopment potential, given the limited supply of land – especially in downtown Vancouver.”

South of the border

Meanwhile, the U.S. market lagged slightly behind with 21 of 40 markets reporting reduced investment activity compared to last year. The survey shows that investors coveted U.S. office and multifamily product, while more capital flowed into the industrial sector compared with the same period one year ago.

“With record amounts of capital still seeking a home, investors continue to find ways to buy into Canada’s finite investable commercial real estate sector,” notes Bill Argeropoulos, Principal and Practice Leader, Research (Canada) for Avison Young. “Capital from domestic and foreign investors continues to be largely directed towards Vancouver and Toronto, while the other major markets are also seeing their share of activity.”

On the vendor side, Argeropoulos notes that capital recycling continues in order to reduce debt, upgrade asset quality and diversify investments geographically.

“Surplus capital that can’t be placed domestically often finds its way south of the border, as Canada has retaken its place as the primary source of foreign investment in U.S. commercial real estate,” he says. “Canadian institutional buyers, such as Ivanhoé Cambridge, Oxford Properties and the Canada Pension Plan Investment Board – on their own or in joint-ventures – were active during the first half of 2017 across major U.S. markets, including Chicago, Los Angeles, New York, San Francisco and Washington, DC, with office properties being the most notable assets purchased.”

Notable investment and multifamily market highlights:

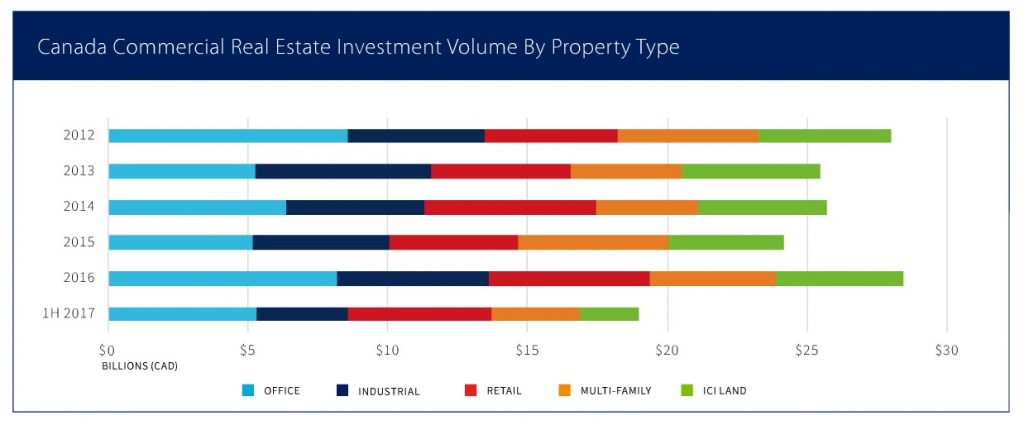

- Following a record $28.4 billion in commercial real estate investment sales in 2016, Canada’s six major markets had first-half 2017 sales of almost $19 billion – up $4.3 billion, or 29 per cent, compared with the first half of 2016. Investors coveted office and retail assets, which combined for more than $10 billion in trades, or 55 per cent of the first-half investment tally.

- Vancouver ($7.8 billion/41 per cent share) outpaced Toronto ($6.5 billion/34 per cent share) with investment proceeds surging 75 per cent year-over-year as vendors sought to capitalize on strong demand and peak pricing. With the exception of Ottawa (which saw investment activity plunge per cent), the remaining markets – Calgary, Edmonton and Montreal – all recorded increases year-over-year, and each exceeded the $1-billion mark.

- Supported by notable $200-million-plus transactions, office was once again the top investment sector with $5.3 billion in sales, while the retail sector was a close second with $5.1 billion in transactions. This result was bolstered by tremendous interest in Vancouver, which saw its country-leading retail investment total nearly quadruple year-over-year to $3.1 billion. Toronto was a distant second, with $1.3 billion in volume.

- The Canadian multifamily sector brought in $3.2 billion in first-half transactions (17 per cent share). Perhaps the most restrained markets by scarcity of available product, Ottawa and Toronto registered declines compared with first-half 2016; meanwhile, sales in Vancouver increased 146 per cent to more than $1.5 billion, leading the country.

- In Toronto, multifamily properties were once again the least-traded asset class, and perhaps the most impacted by the lack of available product for sale while still commanding the lowest cap rates.

- In Montreal, multifamily properties were the most-traded asset class, representing 30 per cent of the overall first-half 2017 dollar volume, with close to $501 million in transactions.

- Average cap rates were marginally lower across all markets and all five asset types (with the exception of suburban class A office, which was flat) compared with one year earlier. Multifamily assets commanded the lowest yields – closely followed by retail – while overall rates showed the greatest compression year-over-year in Vancouver and Toronto.

A few notable 2017 apartment transactions:

- 5999 Monkland Avenue, Ottawa – $46,400,000 ($272,941 per unit)

- Edgewater on Jasper, Edmonton – $191,000,000 ($275,216 per unit)

- Parkview Village Apartments, Calgary – $35,700,000 ($175,000 per unit)

For the full report, visit: www.avisonyoung.com