An analysis by savvynewcanadians.com breaks down complex financial data from CMHC and Statistics Canada to reveal how much debt Canadians are carrying in different cities across the nation. The report looks at various types of debts, from mortgages to credit cards and car loans, using official figures from late 2019 to mid-2023. Findings paints a clear picture of Canada’s economic state and shows how debt is spread out across the country’s urban areas.

Key findings include:

- Canada has the highest household debt levels among G7 nations with 74.3% of its debt in mortgages.

- Mortgage debt contributes 22.88% to Canada’s total consumer debt, driven by limited housing supply and increased borrowing.

- Vancouver’s per capita consumer debt is the nation’s highest, growing by 14.14% since 2019 due to high housing prices.

- Victoria leads in credit card debt per capita at C$12,874, reflecting a 2.72% growth since 2019 and showcasing its residents’ spending habits.

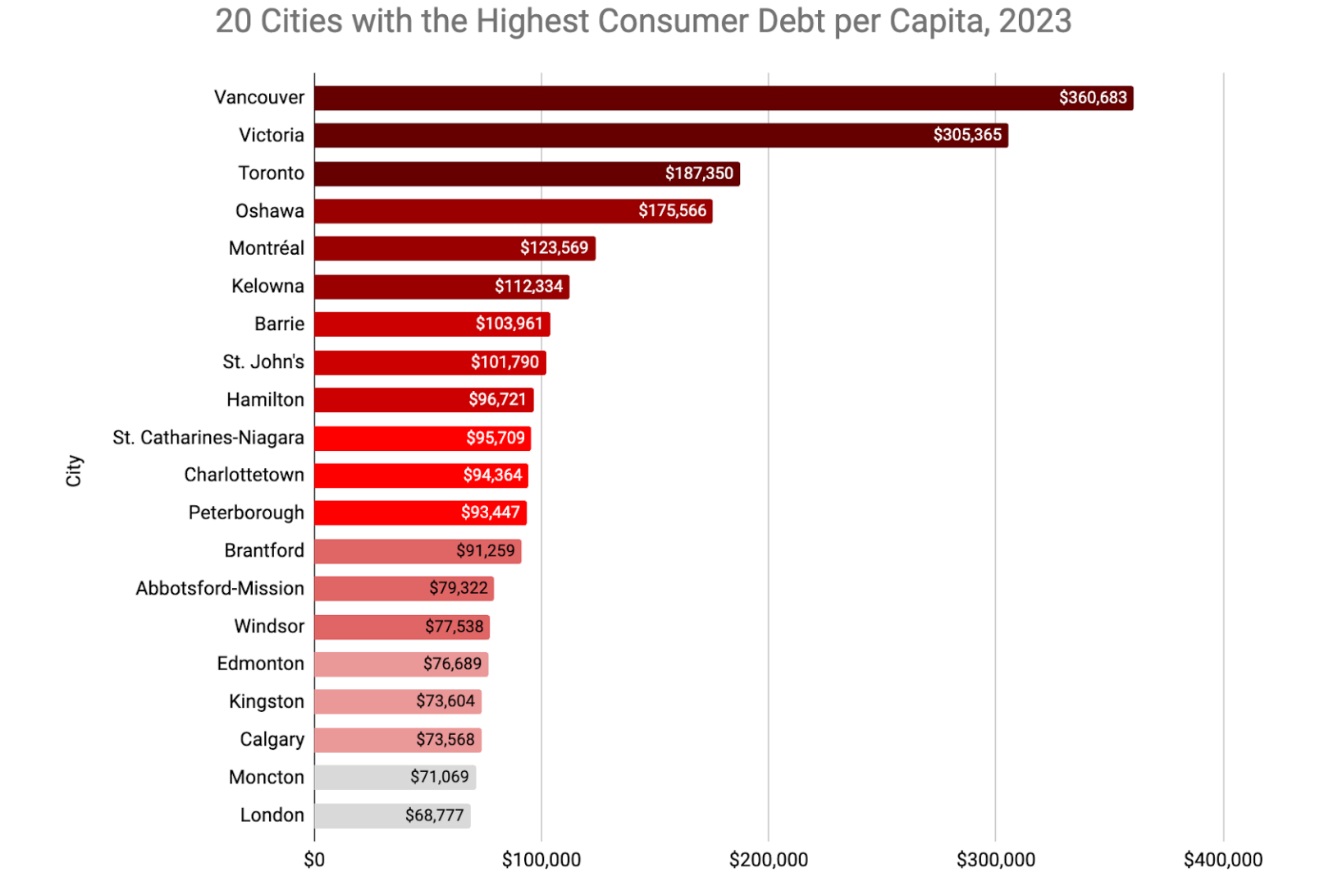

T op 20 cities

op 20 cities

- Vancouver

Vancouver confidently holds the crown at rank one, with no fluctuation in its per capita debt of C$360,683, standing testament to the city’s status as a premium urban enclave despite a steady population of 662,248.

- Victoria

Victoria’s per capita debt gently ebbs by 0.14% to C$305,365, a reflection of the city’s prudent financial currents amidst its population of 93,664, often seen as a retreat for both the affluent and the conservative spender.

- Toronto

Canada’s economic titan, Toronto, sees a subtle 0.31% uptick in per capita debt to C$187,350, a number that mirrors the vibrancy and the cost of its bustling streets which are home to 2,794,356 people.

- Oshawa

Oshawa, with its robust 0.64% growth in per capita debt to C$175,566, suggests a community of 175,383 residents engaging with the city’s economic revival, leveraging opportunities in a transforming industrial landscape.

- Montréal

Montréal, the cultural mosaic, notes a 0.30% increase in debt per person to C$123,569, a modest stride in the financial fabric of 1,762,949 inhabitants, balancing its historic charm with contemporary urban challenges.

- Kelowna

Set against the backdrop of picturesque vineyards, Kelowna registers a 0.40% rise in per capita debt to C$112,334, reflecting the aspirational lifestyle of its 144,576 residents.

- Barrie

With a ripple of growth at 0.66% to C$103,961, Barrie is an emergent node of commuter and local economic activity for its 147,829 residents, perhaps indicative of the spillover from Toronto’s economic engine.

- St. John’s

St. John’s sees a contraction of 0.67% to C$101,790, signaling a community of 110,525 tightening the belts against the harsh winds of economic uncertainty.

- Hamilton

Hamilton climbs 0.57% to C$96,721 in per capita debt, with 580,412 residents navigating through the city’s industrial evolution and embracing the cost of urban renewal.

- St. Catharines-Niagara

The combined region presents a 0.17% increment to C$95,709, where 231,218 individuals live amidst the interplay of tourism-driven commerce and the nuances of border economics.

- Charlottetown

With its modest 0.12% rise to C$94,364, Charlottetown depicts a slow-paced increase in the fiscal responsibilities of its 38,809 residents, maintaining its character as a quaint yet economically steady capital.

- Peterborough

This city reflects a 0.28% increase to C$93,447, hinting at a gentle fiscal momentum among its 83,651 denizens, possibly tied to its manufacturing and educational sectors.

- Brantford

Brantford ticks up 0.35% to C$91,259, where 104,688 inhabitants resonate with the city’s manufacturing pulse and the corresponding financial cadences.

- Abbotsford-Mission

This city marks a 0.42% rise to C$79,322, a mirror to the ambitions of its 195,043 residents, balancing agricultural richness with suburban growth.

- Windsor

Windsor’s 0.60% increase to C$77,538 reflects the economic intertwinement of its 234,954 residents with the automotive and manufacturing sectors, underscored by cross-border influences.

- Edmonton

Edmonton reveals a 0.68% downtick to C$76,689, where the 1,010,899 residents may be echoing a broader provincial shift in financial attitudes amidst an oil-reliant economy.

- Kingston

Kingston’s slight 0.08% growth to C$73,604 could be whispering tales of steady academic investment among its 135,687 inhabitants, nestled within a historic setting.

- Calgary

Calgary’s per capita debt dips 0.28% to C$73,568, a subtle but indicative trend among its 1,306,784 residents, balancing the dynamism of its oil and corporate sectors with fiscal prudence.

- Moncton

A 0.20% increment to C$71,069, for its 90,174 residents, could be indicative of growing consumer confidence in a city poised as a logistical hub.

- London

London rounds out the list with a 0.44% rise to C$68,777 in per capita debt, as 422,324 individuals navigate the financial demands of a city anchored in education and health sciences.

For the full report, click here: Canada’s Consumer Debt Surge 2023.