As Canada and the world struggle to mitigate the spread of COVID-19, it’s hard to fathom that less than a month ago, the rental housing industry was virtually untouched by the extreme pressures now threatening to put many small landlords (and most businesses) in financial distress.

With March winding to a close and out-of-work Canadians unable to make rent payments, the world is suddenly a very different place. On the investment side, not much is happening given the uncertainty of how deep and long this recession could go on. Apartment sales like everything else have stalled.

According to Altus Group, major forecasters in Canada are starting to sharply reduce their outlooks for the economy, with the consensus changing day to day, but generally being that we’re headed for a technical recession, with some recovery in late fall but essentially no growth in real GDP for the year.

In Altus Group’s latest housing report, analysts are forecasting that Canada’s economy will advance by 1.8% this year and accelerate modestly into 2021. And while last year’s job growth will likely not be repeated, best estimates indicate above average growth of 230,000 net new jobs this year and 190,000 for next.

In terms of housing starts in 2020, Altus Group says Canada should match last year on the strength of Ontario, Alberta and Saskatchewan.

“While we recognize that the world has quickly changed, we feel it is important for our readers to understand that the solid fundamentals had put the housing sector on very solid ground before the recent shocks,” the report states. “In other words, the housing sector went into the current environment in as good a position as possible to be able to post a quick recovery once everyday life goes back to normal.”

A look back at the rental market: February 2020

Rentals.ca and Bullpen Research & Consulting recently released their monthly rental report, looking at rental statistics across Canada. According to the latest data, the national average rental rate dropped 3 per cent month over month and 3.4 per cent year over year in February.

Average monthly rent was down (or flat) for one-bedroom and two-bedroom homes in most cities, but a few municipalities bucked the trend including Brampton, Kingston, Burnaby and Quebec City.

Toronto had the highest average monthly asking rent ($2,322) for rental apartments, with Vancouver close behind ($2,155), while Saskatoon had the lowest ($985).

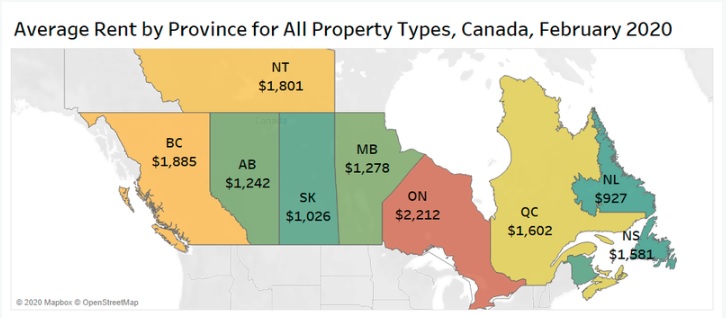

On a provincial level, Ontario had the highest rental rates in February, with landlords seeking $2,212 per month on average for all property types. British Columbia had the second highest rental rate at $1,885 per month, while Newfoundland and Labrador had the lowest at $927. With the exception of Quebec, all provinces experienced a month-over-month decline in average rents between January and February.

Given the unprecedented events of March 2020, what will this month’s data look like?

“Following two years of high rent growth in Canada outside of the commodity-driven markets, rental rates have softened considerably in 2020,” said Ben Myers, president of Bullpen Research & Consulting. “In the face of a global health crisis, the number of people making major life decisions, like moving or changing jobs, will be significantly reduced and landlords will have to decide to either lower rents, offer incentives, or simply wait and hope for some return to normalcy in a couple of months.”

Tenants adhering to social distancing and self-isolation practices are required to remain at home for the foreseeable future, indicating we won’t be seeing the usual shift between tenancies that the spring months typically bring.

Additionally, immigration will temporarily grind to a halt while the borders remain closed throughout the state of emergency. Some young adults living at home, or who’d been planning a move for a job or school are now stuck, not knowing when school will resume and when, or if, their employment will start.

“We are going to see a drop-off of walk-in showings for apartments across Canada during the Covid-19 pandemic,” said Matt Danison, CEO of Rentals.ca. “Landlords and property managers will need to embrace virtual leasing as much as possible to keep their staff and potential renters safe during this difficult time.”

For the complete report, click here: https://rentals.ca/national-rent-report