According to new research from global financial comparison platform Finder.com, more than 3.4 million Canadians believe homeownership may be permanently out of reach, particularly in the frame of the current COVID-19 pandemic.

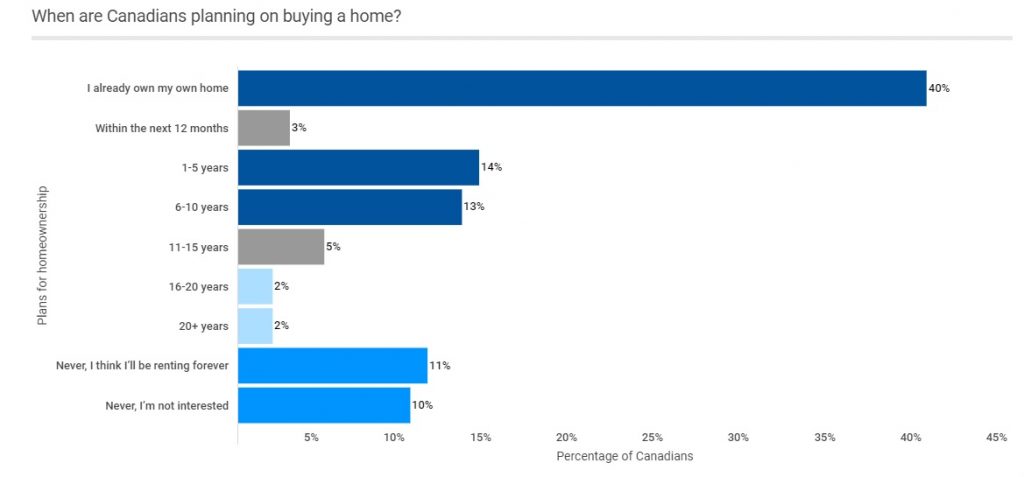

Of Finder’s 1,213 survey respondents, approximately 11 per cent said they will likely be ‘forever renters’, with females less hopeful than their male counterparts. 13 per cent of women (compared to 9 per cent of men) stated they will likely never be able to afford a house, even though 7 per cent more women currently own their homes.

That said; younger Canadians appear to be the more hopeful despite the current economic crisis: 81 per cent of Gen Z (18-24) said they believe homeownership is in their near or distant future.

William Eve, Country Manager at Finder.com, said would-be first-time home buyers are facing an uphill battle with incredibly high home prices that have them feeling locked out of the real estate market: “It was surprising that 81 per cent of young Canadians are so optimistic they will be homeowners, despite the high housing costs they are facing, compared to previous generations. Still, record low interest rates have been the norm for most of their lives so even with a higher mortgage, home ownership may be seen as a smart and even affordable alternative to renting, especially in some of Canada’s biggest cities.”

Eve also stated there could be opportunity in the coming months for first-time home buyers that have been waiting to see price drops to break into the market.

“If these buyers can accept they will have fewer listings to choose from due to the impacts of the economic shutdown, the positive is they may have less competition from other buyers when putting in an offer in urban markets like Toronto or Vancouver, where bidding wars were often the norm pre-pandemic,” he said.

For the full report, visit: www.finder.com/ca/generation-rent