Strong rental demand continued to outpace supply in 2023, according to CMHC’s newly released 2024 Rental Market Report. This resulted in less available purpose-built rental apartments and lower affordability in Canada’s primary rental market.

As per the latest data, released January 31st, the national vacancy rate for Canada’s primary rental market reached a new low of 1.5 per cent in 2023, the lowest recorded rate since 1988 when CMHC began recording a national vacancy rate. Average rent growth for two-bedroom purpose-built units surveyed in both 2022 and 2023 reached 8 per cent in 2023, well above historical averages.

“Again in 2023, strong rental demand continued to outpace supply in communities across the country, making it very difficult for renters to find housing they can afford,” said Kevin Hughes, CMHC’s Deputy Chief Economist. “The vacancy rates and rent increases we are observing are further evidence the current level of rental supply in Canada is vastly insufficient and the need to increase this supply is urgent.”

Increased demand pressures

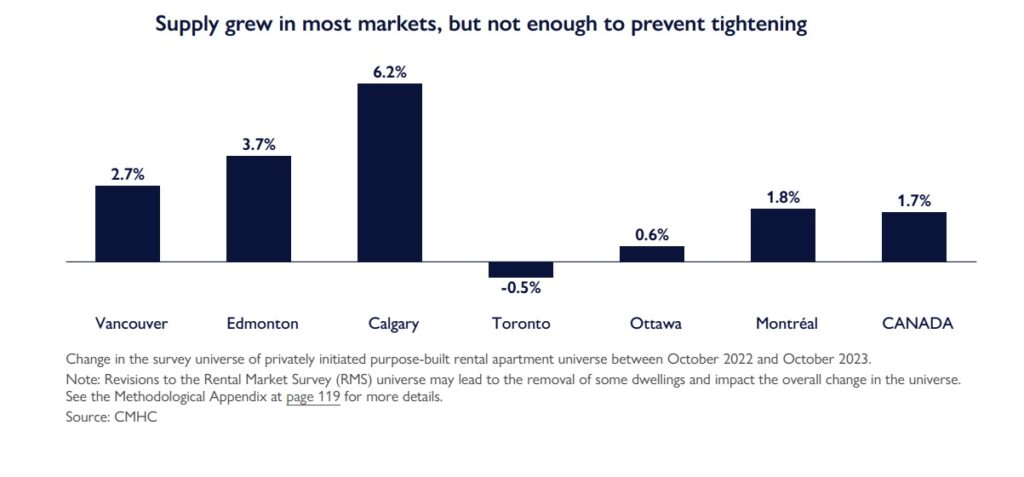

Although most Canadian cities saw an increase in rental supply, CHMC says it was not enough to keep pace with the increased demand pressures caused by high population and employment growth. Higher mortgage rates and persistently high home prices also continued to make it harder and less attractive for renters to transition to homeownership. As rental demand pushed up, the construction of new rental homes continued to be difficult for homebuilders facing higher costs for financing and construction materials, along with labour shortages.

In terms of escalating rent prices, average national rent growth for a 2-bedroom purpose-built apartment accelerated sharply to 8 per cent from 5.6 per cent over the previous 12-month period. This new high is well above the 1990 – 2022 average of 2.8 per cent and outpaced both inflation (4.7%) and wage growth (5%).

Calgary tied Toronto in 2023 for the second-lowest vacancy rate out of the six largest Canadian cities, as Calgary was particularly affected by high levels of interprovincial migration, in addition to significant international migration. Montréal’s vacancy rate dropped to a low not seen since before the pandemic, while Calgary and Edmonton both saw their lowest vacancy rates in a decade. Meanwhile, vacancy rates held steady in Vancouver and Ottawa, with Vancouver remaining Canada’s tightest major rental market with the highest monthly average rents.

Calgary tied Toronto in 2023 for the second-lowest vacancy rate out of the six largest Canadian cities, as Calgary was particularly affected by high levels of interprovincial migration, in addition to significant international migration. Montréal’s vacancy rate dropped to a low not seen since before the pandemic, while Calgary and Edmonton both saw their lowest vacancy rates in a decade. Meanwhile, vacancy rates held steady in Vancouver and Ottawa, with Vancouver remaining Canada’s tightest major rental market with the highest monthly average rents.

A challenging climate for developers

As purpose-built rental developers in Canada continue to face an increasing number of market challenges, including higher construction costs, government fees, and lending rates compared to a few years ago, housing experts are in agreement that more needs to be done to encourage new rental housing development. Although Canada and the Provinces introduced some promising new measures in 2023, including the Enhanced GST Rental Rebate program, according to a CMHC study released in December, achieving an adequate level of supply would require an investment of at least $1 trillion.

“The wavering economic environment characterized by higher interest rates, construction costs and development fees has put the financial feasibility of numerous planned rental projects to the test,” the report contends. “These more restrictive financial conditions have limited the flow of private investments into new purpose-built rental housing, resulting in a decrease of planned projects and further fueling the affordability crisis.”

CMHC research conducted earlier in 2023 showed that most of the recent purpose-built rental housing stock in Canada is owned and developed by the private sector. To launch the construction of new rental development projects, return expectations by investors need to be met. As a result, larger-scale developers with the deepest pools of capital and a greater ability to source upfront equity have been playing a significant role in the development of new rental housing. On the other hand, smaller developers with larger financial indebtedness were more likely to pause their new projects or reduce the number of future projects they’d originally planned to build. Of these, approximately 40 per cent indicated an intent to reduce the number of future projects while 30 per cent indicated they would put their new projects on hold.

For most rental projects paused or cancelled in 2022, the limited return premiums were what motivated the decision. Meanwhile, developers who decided to move along with their projects saw the need to raise rents to offset increasing borrowing, construction, and development costs as their primary strategy to incur profit.

Looking ahead

CMHC estimates that larger-scale developers (1,000+ units) will be responsible for more than three out of four new rental units in the coming years; they also represent roughly nine out of 10 developers that are currently leveraging public sector funding, such as CMHC programs – hence incorporating a greater share of affordable housing units into their portfolios. That said, market rent was mentioned as the most common product strategy.

Partnerships between larger institutional investors, such as pension funds and public companies (REITs), and private developers can allow for reduced upfront cost and greater access to alternative financing. These partnerships are critical moving forward and were mentioned by survey participants as being increasingly leveraged to build new rental housing.

“Larger-scale developers are seemingly putting more focus into creating affordable housing opportunities,” CMHC analysts noted. “Collaboration and partnerships between different development typologies and investors will be foundational in the future rental housing development ecosystem.”

For CMHC’s latest Rental Market Report, click here: Rental Market Report | CMHC (cmhc-schl.gc.ca)