Starlight Investments announced it has completed the acquisition of a 44-building concrete, multi-residential, high-rise GTA portfolio for a purchase price of $1.735 billion. In total the portfolio comprises 6,271 rental units.

“The opportunity to acquire a 44-building concrete, multi-residential, high-rise portfolio located in the Greater Toronto Area with the prospect of developing an additional 3,000 infill units is an important step in Starlight’s strategic growth,” said Daniel Drimmer, Starlight’s President and Chief Executive Officer We look forward to integrating each property into our multi-residential platform.”

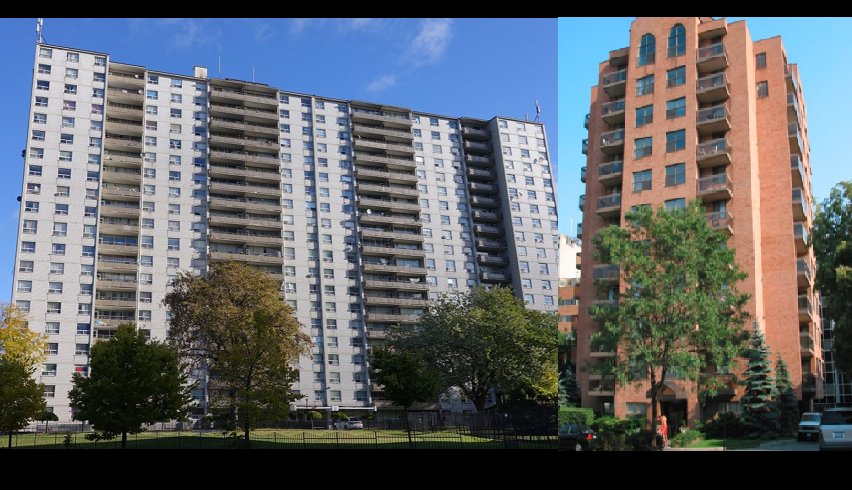

Properties within the portfolio are situated in a number of the Greater Toronto Area’s municipalities including Toronto, Mississauga, Hamilton and Oshawa as well as City of Ottawa. Suite types within the portfolio range from bachelor to three-bedroom units. The buildings offer spacious suites, kitchens with full appliance packages, outdoor patio/balcony space, professional onsite building management, tenant and guest parking, and is well-situated close to essential neighbourhood amenities.

Each property will be managed individually by one of Starlight’s trusted property management companies: Greenwin, Sterling Karamar, MetCap Living, Cogir Real Estate or DMS.

Some of the properties include:

- 2450 & 2460 Weston Road, Toronto

- 125 Bamburgh Circle, Toronto

- 77 Roehampton Avenue, Toronto

- 71 Thorncliffe Park Drive, Toronto

“We are thrilled to announce the acquisition of this portfolio,” said David Chalmers, Starlight’s President of Canadian Multifamily. “The properties are ideally suited for integration into our existing platform. Congratulations to all of the parties involved in this landmark transaction.”

The acquisition of the portfolio further strengthens Starlight’s presence in the Greater Toronto. The privately held Toronto-based, full service, multifamily and commercial real estate investment and asset management company currently manages over $13.0 billion in direct real estate, as well as real estate investment securities.

Investment vehicles include institutional joint ventures, True North Commercial REIT, Starlight U.S. Multi-Family Funds and Starlight Capital Funds. Starlight Investment’s portfolio consists of approximately 36,000 multi-residential units across Canada and the U.S. and over 6.2 million square feet of commercial properties.